workers comp filing taxes

Dont let your taxes become a hassle. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Is Workers Comp Taxable No Unless

E-File Your Tax Return Online.

. File On Your Own With Expert Help Or Get A Full Service Experience. If there is no computer available provide the employee with the appropriate paper form Form CA-1 to file for. IRS Publication 907 reads as follows.

Workers compensation benefits arent usually taxable at the federal or state level. It is not considered income when filing your taxes. If you received your workers compensation under a workers compensation act or a statute in the nature of a workers compensation act it is not taxable and they should not.

No you usually do not need to claim workers comp on your taxes. File your taxes at your own pace. Ad For Simple Returns Only File Free Now Even When An Expert Does Your Taxes.

The quick answer is that generally workers compensation. Ad For Simple Returns Only File Free Now Even When An Expert Does Your Taxes. File On Your Own With Expert Help Or Get A Full Service Experience.

Your workers compensation benefits over an entire tax year will remain non-taxable. Workers compensation is not taxable income. Ad Our Easy to Use Software Helps You Prepare and E-File Your Tax Return.

Workers compensation benefits are not normally considered taxable income at the state or federal level. Quickly and easily file your workers compensation quarterly reports with QuickFile. Do you claim workers comp on taxes the answer is no.

Ad Filing your taxes just became easier. The same holds true for workers comp settlements. In some cases the.

Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a.

Taxpayers who meet the requirement to file based upon income and filing. Advise the employee to e-file the claim using SHIMS. File your taxes stress-free online with TaxAct.

However tax codes change so you should contact our office an accountant or your tax preparer to discuss the details of your situation before filing your taxes. The answer is no. When Is Workers Compensation Taxable.

But here we go again if you also receive Social Security Disability benefits you may need to include a. There are special rules regarding reporting workers. Simply put workers compensation carries no tax or tax rate.

However if you resume work for any amount of time including on light duty you will. Although most income is taxed at different rates it is generally taxable. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements.

In general workers compensation is not taxable income and therefore is not reported on your federal tax return. In most cases its not. The lone exception arises when an individual also receives disability benefits.

Many businesses are facing financial strain because of the coronavirus. Thats because the benefits.

Kentucky Department Of Insurance Approves Annual Workers Comp Filing

Is Workers Comp Taxable Gordon Gordon Law Firm

Is Workers Comp Taxable Workers Comp Taxes

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Fica Taxes Unemployment Insurance Workers Comp For Owners

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Are The Benefits From Workers Compensation Taxable In Texas D Miller Associates Pllc

Is Workers Comp Taxable Income In Michigan What You Need To Know

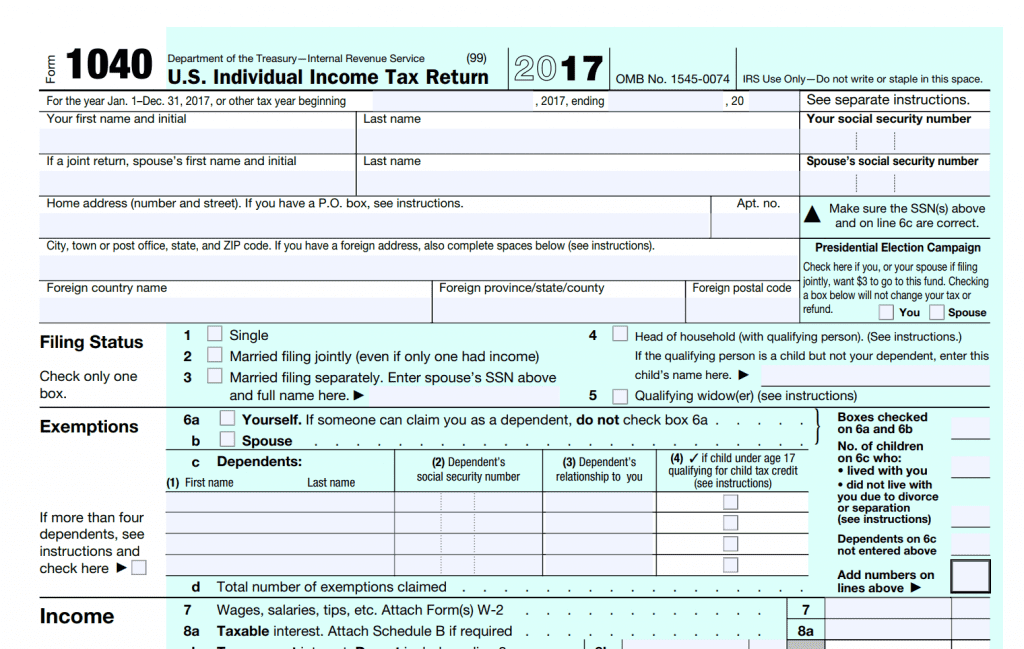

How To Deduct Workers Compensation From Federal Tax Form 1040

When Does Workers Comp Start Paying Benefits Or When They Should

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Are My Vermont Workers Compensation Benefits Taxed

Workers Compensation Attorneys In York Pa Free Confidential Consultation

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Do I Pay Taxes On My Workers Compensation Settlement In Ohio